Please try the following to find what you’re looking for:

- Check your spelling

- Try different words or word combinations (E.g. "fund form")

$3 million super tax (Division 296 Tax)

What it is, who’s affected, and how it’s calculated

What is the Division 296 Tax?

Division 296 is a proposed tax measure announced by the Labor Government. It introduces an additional tax on certain earnings associated with an individual's Total Superannuation Balance (TSB) where that balance exceeds $3 million. The originally proposed measures had caused some concerns, particularly the proposal to tax unrealised capital gains and the absence of indexation to the $3 million threshold.

What’s the status (last updated 10 February 2026)?

On 19 December 2025, the Federal government released the draft Better Targeted Superannuation Concessional Bill 2025 for consultation. The consultation period recently closed on 16 January 2026. We await feedback from Treasury on the outcomes for the consultation period and any impacts on the released draft of the Bill.

Here is a key summary of this released draft Bill:

When is the commencement date of this reform?

- Commencement date will be from 1 July 2026 for the 2026/27 financial year.

How do you calculate Division 296 tax?

- The calculation of the Division 296 Tax will be similar to the previous announcement which is:

proportion of TSB above relevant threshold x earnings x relevant tax rate

- As previously announced, the relevant threshold and tax rate are as follows:

- $3million: 15% extra tax on realised earnings for the proportion of the TSB value above this threshold

- $10million: further 10% extra tax (25% in total) on realised earnings for the proportion of the TSB value above this threshold

In 2026/2027, the TSB value that will be used for this purpose will be the TSB value at the end of the financial year. However, from the 2027/28 financial year onwards, an individual’s TSB at both start and end of the financial year will be assessed for the Division 296 Tax purposes, with the higher of the two balances used in the calculation.

- Both thresholds will be indexed with inflation (increasing in steps of $150k for the $3 million threshold and in steps of $500,000 for the $10 million threshold).

- Earnings will be based on taxable income, adjusted for elements such as assessable contributions and net exempt current pension income. Modified rules apply to pooled superannuation trusts, retirement savings account providers and defined benefit accounts.

CGT adjustments

- The Government acknowledges the value that has accrued in superannuation prior to the commencement of the Bill. To ensure Division 296 Tax applies only to future earnings, the draft Bill introduces transitional CGT adjustments that recognise this pre-commencement value. ‑commencement value.

For small superannuation funds (SMSFs and SAFs)

This provision will allow small superannuation funds, such as a self-managed superannuation fund (SMSF) or a small APRA fund (SAF) to elect to adjust the cost base of the fund’s CGT assets that it held on 30 June 2026 to the market value of those assets on that day.

The election must be:

- made in the approved form,

- be for all CGT assets held by the small superannuation fund at the end of 30 June 2026 and

- be made by the end of the due day for the lodging of the income tax return for the 2026-27 income year.

Once a nomination is done, it cannot be revoked and will apply to all assets for every member within the fund.

For larger superannuation funds

For larger funds, the realised gains for the first 4 financial years (2026/2027 financial year to 2029/2030 financial year) will be adjusted by multiplying them with a factor which will be prescribed by regulations.

The legislation has not yet been introduced to Parliament, and a number of important details will still need to be clarified through regulations. These include:

- How fund earnings will be allocated to members across both large APRA regulated funds and small funds, including what will be considered a fair and reasonable

- How defined benefit interests will be valued and how earnings will be reported, such as the valuation approach and the prescribed factors used to calculate earnings.

- How the factor method for adjusting CGT for ‘other superannuation funds’ (e.g. retail super products) will work in real life.

- How different types of superannuation interests will be treated, particularly older or legacy products whose unique features may lead to unintended or inappropriate outcomes under the Division 296 framework.

Who will be affected by Division 296 Tax?

The Division 296 Tax will apply if an individual’s TSB before the start or at the end of the financial year is above $3 million and their superannuation earnings are more than nil.

There will be a transitional arrangement for the 2026/27 financial year under which (only) an individual’s TSB at the end of this first financial year (i.e. 30 June 2027) will be assessed against the relevant thresholds.

This means:

- Individuals with high superannuation balances (i.e. exceeding or soon likely to exceed $3 million) across all phases (accumulation and retirement) may be impacted.

- Even if part of the balance is in a tax-free retirement phase, it still contributes to the TSB and may trigger the tax.

- The measure is designed to target wealthier superannuation holders.

Do I need to take any action right now?

The final legislation has not yet been introduced into Parliament, and as a result, the Division 296 tax is not yet law. Given the absence of final details and the possibility that the legislation may change from this draft, individuals may wish to wait until the legislation is finalised before considering whether any strategic adjustments are appropriate for their circumstances.

Based on the draft, the commencement date is 1 July 2026, with the first relevant date being 30 June 2027 (under the transitional arrangement). This provides individuals with time to consider their options once the legislation is finalised.

In the meantime, if you are a member of a self-managed superannuation fund (SMSF) or a small APRA fund (SAF) and your fund holds unlisted assets, such as real property, please ensure that accurate valuations for these unlisted assets are obtained for the 2026 financial year. In addition, you should ensure the cost bases of all investment holdings within the fund are properly documented and up to date.

Who should seek financial advice?

Individuals with superannuation balances approaching or exceeding $3 million may wish to understand how the proposed measures could apply to their circumstances.

You should consider seeking tailored tax and financial advice if you are in any of these situations:

- Single-asset Self Managed Super Fund

Particularly if the asset is illiquid, such as property or unlisted investments - Significant balance but no access to super

For example, if you haven’t met a “’condition of release’” you may wish to may wish to obtain financial advice regarding any contribution strategies relevant to your circumstances. - Significant balance and able to access your super

You may have options that may influence how the proposed tax could apply to you, depending on your personal circumstances. . These options should be reviewed holistically in conjunction with your overall investment strategy and any asset holdings and incomes outside of superannuation. - Individuals with specific estate planning requirements

Any strategies with regard to your superannuation balance should be considered in conjunction with any estate plans that you and your family have in place.

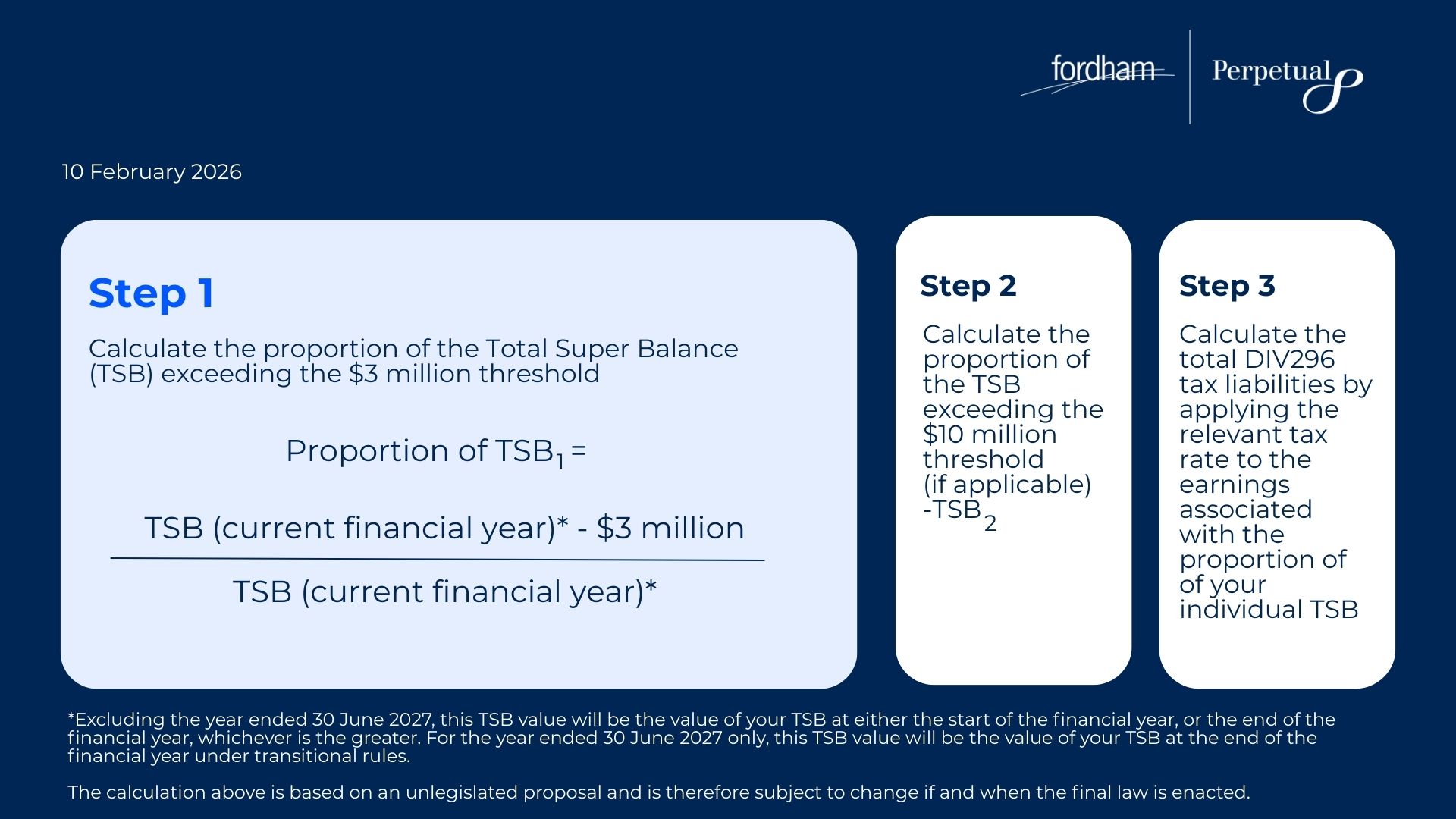

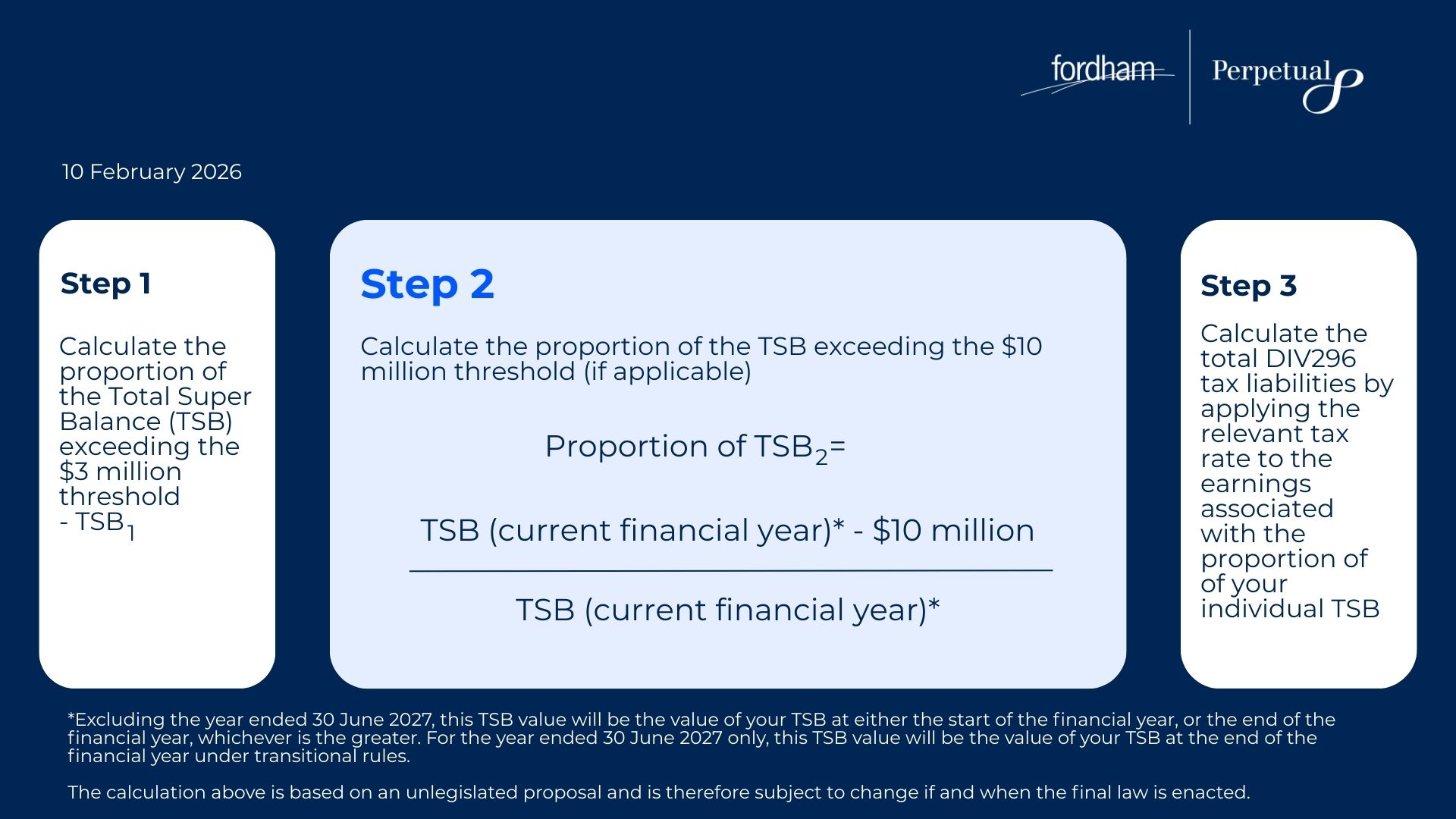

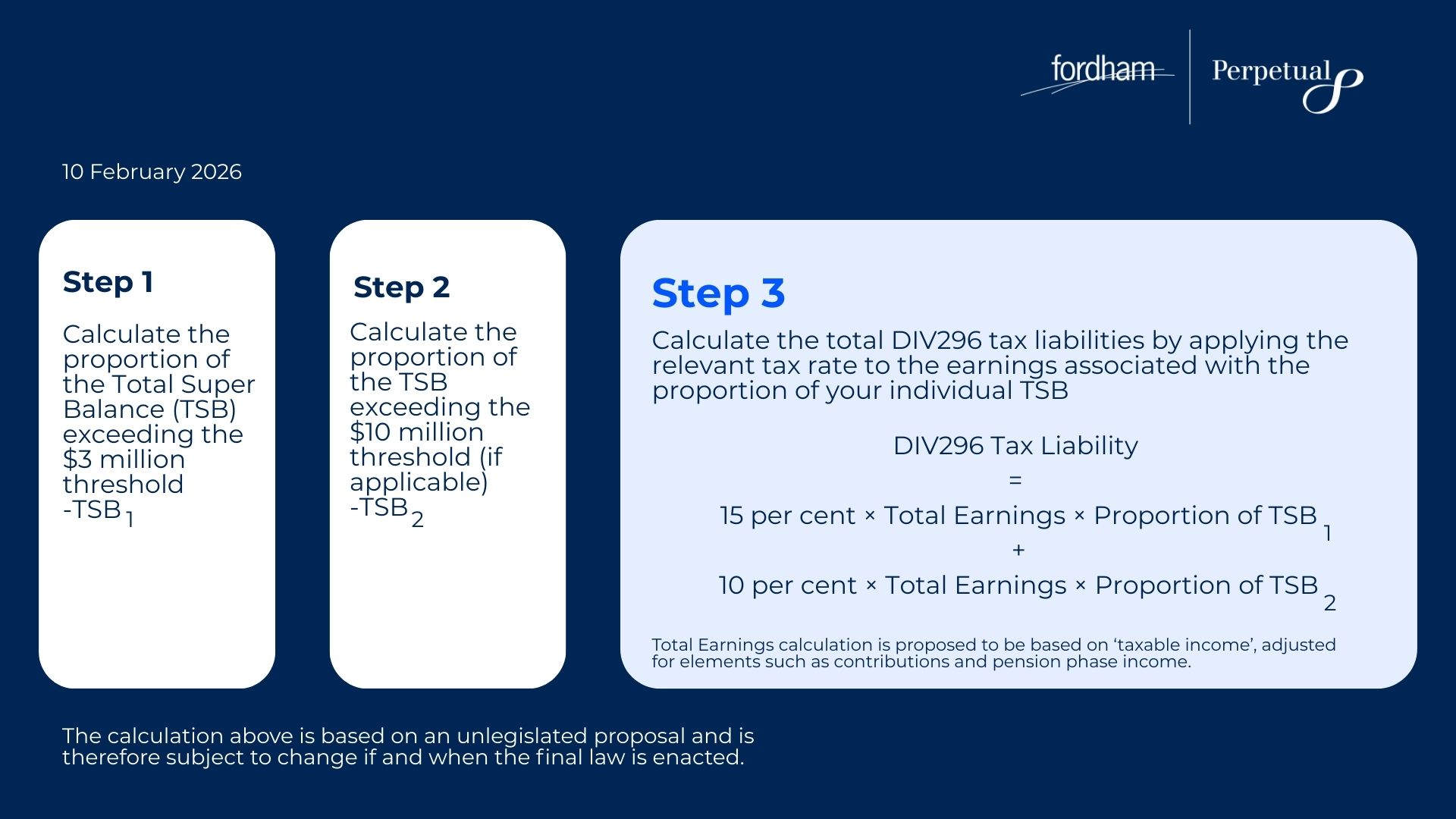

How the new proposed Division 296 calculation works

Whilst the following is based solely off the government’s announcement from 19 December 2026, to work out the new revised calculation of Division 296 tax, follow the steps in the images, followed by a worked example.

Step 1: Calculate the proportion of the Total Super Balance (TSB) exceeding the $3 million threshold.

Step 2: Calculate the proportion of the TSB exceeding the $10 million threshold (if applicable)

Step 3: Calculate the total Division 296 tax liabilities by applying the relevant tax rate to the earnings associated with the proportion of your individual Total Super Balance (TSB).

Worked example: Beverley has a Total Super Balance (TSB) of $20m on 30 June 2027. During the financial year 2026/27, her super has realised earnings of $1,000,000. Therefore, the new proposed Division 296 tax is calculated as follows...

Potential strategies to consider

The legislation for Division 296 is not yet law, and every individual’s circumstances are unique - seeking personalised financial advice is strongly recommended before taking any action.

Should you consider withdrawing funds and investing elsewhere, you can only do so if you meet an eligible condition of release. Once withdrawn from the superannuation environment you may be ineligible to recontribute these funds back.

Investing in your personal name (tax up to 45% plus Medicare levy), a company (typically taxed at 30%), or a family trust (subject to beneficiaries’ personal tax rate) may offer different outcomes. This would require financial modelling to compare overall tax positions.

Even with Division 296, the super environment may still offer better after-tax returns, particularly if your fund is either wholly or partially in retirement phase. Additionally, withdrawing funds to reduce a client’s total super balance below the $10million threshold as at 30 June 2027 may offer limited (tax) benefit, particularly if the reduction is marginal and exit costs are involved. The effectiveness of such a strategy will depend on the final legislation and how the Division 296 tax is applied.

You may consider spouse contribution splitting or contribution strategies if your spouse or adult children have lower balances (subject to eligibility).

Ensure your fund has sufficient liquidity to meet the Division 296 tax, should it become payable.

Consider Capital Gains Tax implications and transaction costs if liquidating assets.

Review your investment portfolio(s) with a view to structuring them differently.

If you use your superannuation as asset protection or it forms part of your estate plan, you will need to consult with your estate planning adviser to ensure there would be no unintended consequences of changing your superannuation interests.

Got questions about Division 296 and your super?

Speak with our team today to get personalised guidance tailored to your financial situation.

Your best interest at heart

When your financial world is complex, you need more than just advice – you need a team that sees the full picture. Perpetual and Fordham work together to deliver a seamless, end-to-end experience that brings together strategic investment advice, financial planning, and specialist tax, accounting and business advisory expertise.

A holistic experience, delivered by an aligned team

Whether you're navigating investments, structuring your business, or planning for retirement, our integrated approach means you don’t have to go anywhere else. Sit down with your Perpetual financial adviser and Fordham tax specialist – together. With one team aligned around your goals, you can move forward with clarity and confidence.

Perpetual is an ASX-listed, diversified financial services company which has been serving Australians since 1886 when it was established as a trustee company by a group of businessmen including Sir Edmund Barton, later to be Australia’s first Prime Minister. That trustee heritage – and the culture it created around putting clients first – is what makes Perpetual unique.

We have been earning the trust of our clients for more than 130 years and pride ourselves on our long-standing client relationships – some of which span five generations.

Trust is earned, every day.

Our approach to financial advice follows a proven methodology - we invest serious amounts of time talking to clients about their needs so we can truly understand where they are now and where they would like to be. We then develop a sophisticated financial plan with a transparent fee structure.

It is at this point that the breadth of the Perpetual service becomes important. We will direct you to a wide range of external service providers if we believe they will best meet your needs.

But within our walls we can also offer you access to specialists in investing (across all asset classes), superannuation, insurance, property, estate planning, philanthropy, business advisory services and tax and accounting. Everything you need to execute a financial plan that gets you to your goals - whether you’re an individual, a business owner, a not-for-profit or an indigenous community.

A crucial part of the overall strategy - whatever your aims - is regular, shared reviews to make sure your strategy stays on track and is adapted to your changing needs (and changes in the economy, legislation or investment markets).

Meet the team

Perpetual Private Partners

Richard McClelland

Partner, NSWRichard McClelland helps High Net Worth individuals and families secure their financial future.

Supported by Perpetual’s broad range of services, Richard helps his clients build, protect and transfer their wealth to the next generation.

Richard’s strengths lie in his ability to obtain a deep understanding of his client’s circumstances, take into consideration their goals; and then develop and monitor a plan to align the two.

Richard is the definition of a holistic Financial Adviser. He has more than 15 years’ experience; has achieved a Masters in Financial Planning, and is a Certified Financial Planner (CFP®).

- His area of specialties encompass:

- Financial Planning

- Superannuation (Inc. SMSF and SAF)

- Wealth protection and asset structuring

- Investment, asset allocation and portfolio construction

- General estate planning

- Charitable planning and philanthropy

When not working Richard enjoys spending time with his family including his Canadian wife and two sons on Sydney’s Northern Beaches. Richard enjoys keeping active via a range of outdoor activities including surfing, mountain biking, running and anything snow related.

Carolyn O'Reilly

Partner, VICCarolyn has over 25 years of wealth management and financial markets experience.

As a Partner within Perpetual Private Carolyn specialises in providing complex strategic and investment advice to high net worth individuals and families. She also specialises in providing financial advice to women and is passionate about improving female financial literacy, enabling women to make financial decisions which promotes security, stability and financial freedom.

Prior to joining Perpetual Private in 2009 Carolyn held roles at Macquarie Private Bank and JP Morgan Chase.

Carolyn has a Bachelor of Economics, Graduate Diploma in Applied Finance, Diploma of Financial Planning and is also a CFP member of the FPA and has completed all FASEA requirements.

Carolyn is also a board member of The Beautiful Bunch, a social enterprise which provides training and employment opportunities for young refugee women.

Tony Mastromanno

Partner, VICTony is the Associate Partner of VIC’s High Net Worth division.

Tony provides sophisticated financial advice to Perpetual’s private clients. He has extensive experience in investment management, retirement planning, superannuation, taxation, estate planning and recommending appropriate strategic structures.

Tony enjoys working closely with clients to develop highly effective investment strategies and structures which help to ensure that their financial goals are achieved.

Tony has a Diploma in Financial Planning – Financial Planning Association of Australia, 2003. He joined the financial services industry in 1993 and has been with Perpetual since 2002. His previous roles and experience in financial services include Financial Adviser and Client Relationship Manager with AMP and the Commonwealth Bank.

Mark Vignaroli

Partner, VICMark is a Partner in a team that specialises in providing a fully integrated wealth management solution to successful business owners and high net wealth families.

Mark is highly qualified and experienced Private Wealth professional with over 25 years’ experience in wealth management and capital markets.

Over the years with the backing of Perpetual’s specialist teams in accounting, tax, philanthropy, investment strategy and research Mark has successfully assisted business owners transition their business wealth to personal wealth, empowered families to achieve their aspirations and successfully transfer wealth to the next generation.

Mark’s main areas of expertise are:

- Intergenerational family wealth planning and inheritance advice

- Retirement planning

- Investment management and asset allocation advice

- Philanthropy.

Mark has a Bachelor of Commerce (Accounting), a Graduate Diploma in Applied Finance, Accredited Estate Planning Strategist and is a Certified Financial Planner (CFP).

Andrew Parker

Partner, Private Clients SAAndrew is the Partner of SA’s Not For Profit division.

With over 32 years experience, Andrew specialises in advice to large complex organisations, family offices, not-for-profit clients and philanthropic trusts. He has a deep understanding of the unique needs and strategic objectives of not-for-profit organisations and helps his clients implement best practice investment policies. Andrew also connects clients to other parts of the Perpetual business, including Philanthropic services.

Prior to joining Perpetual, Andrew held senior adviser roles within commercial and private banking based in Adelaide for the last 9 years. Andrew has also held senior manager roles in institutional banking at JPMorgan Chase, Deutsche Bank and Royal Bank of Scotland in Tokyo, Singapore, London, New York and Sydney over a period of 20 years.

Andrew has a Bachelor of Business (Finance), Advanced Diploma of Financial Planning, is an accredited Self- Managed Super Fund adviser (SMSFA) and speaks several languages.

Antony Pupovac

Partner, QLDWith over 25 years of experience in financial services, Antony Pupovac is a Partner and Financial Adviser at Perpetual Private. His distinguished career spans senior roles at some of Australia’s most respected institutions.

Antony began his advisory journey in 1999, building a reputation for delivering strategic, client-focused solutions across financial planning, investment strategy, investment policy governance, superannuation, retirement income streams, risk management and estate planning. He spent 12 years at Ord Minnett as a Senior Private Wealth Adviser, following 8 years at Commonwealth Private Bank as Senior Wealth Manager Strategic Advice where he honed his expertise in high-net-worth client advisory.

Antony holds a Bachelor of Business, a Diploma of Financial Planning, attained the Certified Financial Planner (CFP®) designation with further accreditation in SMSF’s and registered tax (financial) adviser. He is a member of the Financial Advice Association of Australia.

Based in Brisbane as part of the Private Clients QLD team, Antony brings deep technical knowledge and a collaborative approach to helping individuals, families, business owners, executives, philanthropists and not-for-profit organisations achieve their purpose and financial goals with confidence.

Fordham Partners

Darren Wilson

BBus (Acc), Grad Dip Tax, MTax, CA, FTI Lead PartnerFor more than twenty years, Darren has been providing business, taxation and asset protection solutions to the owners of privately-owned businesses. His passion lies in not only looking after their business needs, but also ensuring the growth and protection of his clients’ family wealth.

Darren has managed many projects to a successful conclusion for his clients including sale of business, matrimonial disputes and ATO audits. He also has significant experience assisting clients with estate planning, business acquisition and business divestment.

His experience covers a broad range of industries including retail, wholesale, professional services and property development. Darren has substantial practical experience in taxation matters and leads Fordham’s internal tax excellence group. This puts him at the forefront of tax minimisation strategies for income tax, capital gains tax, superannuation and GST.

Having completed a Master of Taxation degree to add to his Chartered Accounting qualification and Fellow status of the Tax Institute of Australia, Darren is a regular tax presenter at industry events.

View LinkedIn profile

Michael Sutherland

BBus (Acc), CA, CTA, RG146, FBA, Specialist Accredited Advisor Lead PartnerMichael joined Fordham in 2001 and is now the lead partner of a team of 30 with clients in Property & Construction, Retail/Ragtrade, Transport, Manufacturing and Franchising. He started his career in 1991 with one of the Big Four accounting firms and joined Fordham 10 years later to focus specifically on medium-sized, privately-owned businesses.

As a Chartered Tax Advisor with a wealth of experience in corporate advisory, as well as private businesses, Michael brings this unique perspective to help his clients’ businesses grow and overcome adversity. He helps clients across the broad range of business and personal issues they face including arranging external financing, modelling/forecasting, reporting, shareholder issues, structuring and valuations.

In this role Michael enjoys undertaking strategic planning for his clients and often participates as Board Chair. He runs executive leadership team meetings focused on driving accountability and meaningful improvements to operational performance. He is a regular presenter and author of industry articles for the building and property development sector, as well as Ragtrade industry segments. When not at work, he is chauffeuring four daughters to school, rep basketball and football.

Industry specialisation: Property & Construction, Retail, Manufacturing, Transport, Franchising

View LinkedIn profile

Sharon Parker

BBus (Acc), CA Lead PartnerSharon assists business owner clients across a broad range of industries, helping them to navigate their personal and business wealth journey and weigh up important decisions along the way. She has broad experience in taxation and business with particular expertise in complex tax advice and structuring, planning for succession and retirement and dealing with complex family and community issues.

In addition to working with business owners, Sharon is passionate about leading Fordham’s Indigenous Consulting Team, which is part of Perpetual’s broader service offering to Aboriginal communities. This team provides Executive Office and consulting services to communities across Australia.

Clients enjoy Sharon’s attentiveness, responsiveness, her ability to listen, and to provide targeted and practical advice. She is exceptionally talented at developing strong, long-term relationships, and is known for her ability to communicate complex issues in a way that is easy to understand.

Industry specialisation: Property & Construction, Retail, Native Title

View LinkedIn profile

Neil Cahir

BCom/BEcon, CA PartnerNeil discovered Fordham at a university open day and was immediately drawn to our focus on people, private businesses and premium service. After a recommendation from a friend already working for us, Neil joined Fordham in 2005 as a graduate with our Motor Dealer Services team.

Since then, Neil has worked with a wide variety of clients and tackled a diverse range of issues – from simple family and business issues, to complex sales, acquisitions and everything in-between. In addition to having outstanding taxation and business-structuring capability, Neil also has a deep expertise in commercial advisory services and business optimisation, with a focus on privately-owned motor retailers. In addition to his clients in the motor industry, Neil uses his knowledge and experience to assist business owners across a range of industries.

He has a passion for guiding his clients through the Fordham Wealth Journey®, with a particular focus on the taxation, structuring, profit improvement and succession planning components that are so sought after by today’s business owners.

Happily, Neil’s instincts as a young university graduate were correct. He loves his role at Fordham, loves helping his clients, and it shows … for every client, every day.

Industry specialisation: Motor Dealer Services

View LinkedIn profile

Brett Marshall

BCom/BArts, CA PartnerIn Brett’s 15 years at Fordham, he has developed a very thorough understanding of the property & construction industry. During this time, he has advised a broad range of businesses from large land developers to residential and commercial builders, civil construction companies, and project management businesses. Brett also assists business owners and their families in the retail, publishing, manufacturing and finance industries.

For many of his clients, Brett acts as chair of both their operating and family boards. In these roles he plays a key part in facilitating discussion with business owners, their families, and senior management teams regarding business performance, profit improvement, optimal business structures, and business acquisition and sale opportunities.

Brett has a deep knowledge of the Australian tax system and in particular the specialist tax issues applicable to the property and construction industry. He is also a leader of Fordham’s internal taxation excellence group. In this role he is responsible for strategies to assess the impact and maximise opportunities available with respect to the following:

- Income Tax

- Capital Gains Tax

- Small Business Capital Gains Tax Concessions

- GST (including the margin scheme)

- Stamp duty

- Land tax.

Brett is a member of the Taxation Institute of Australia and Advanced Property Development accredited (PCA). He is also a member of the Taxation & Finance Committee for the Urban Development Institute of Victoria, which advocates for policy improvements to the industry.

Industry specialisation: Property & Construction, Manufacturing, Retail

View LinkedIn profile

Ian Ng

BCom (Acc/Comm Law), MBA, CPA Associate PartnerIan has over 20 years’ experience in tax and accounting administration and advice on Australian superannuation structures, specifically Small-APRA (SAF) and Self-Managed (SMSF) funds. He also specialises in risk and compliance consultancy on the impact of legislative and regulatory pronouncements on SAFs and SMSFs.

In addition, Ian has a wealth of experience in accounting and advice on Australian charitable structures, specifically Private Ancillary Funds, Public Ancillary Funds and Testamentary Charitable Trusts, as well as risk and compliance consultancy on the impact of AASB and ACNC pronouncements on these charitable structures.

View LinkedIn profile

Stay informed with Wealth Management insights

Receive expert insights on wealth management strategies and market trends

Frequently asked questions

No, the proposed Division 296 tax is not yet law. The Better Targeted Superannuation Concessions Bill 2025 was introduced into Parliament for passage on 11 February 2026. It has yet to receive Royal Assent, and at this time is not yet law.

It may be appropriate to seek advice if you are likely to be impacted. At Perpetual, our financial advisers work closely with our colleagues in our Fordham Business Advisors team. Fordham Business Advisors is a specialist business providing clients with accounting, taxation and business advisory services. This ensures a coordinated approach that delivers an outcome appropriate to your circumstances.

Individuals with a total superannuation balance over $3 million, across both accumulation and pension phases, may be affected.

Based on the released draft Bill currently before Federal Parliament, this tax no longer applies to unrealised capital gains, instead it will be taxing the proportion of realised earnings associated with individual’s total super balance over $3 million.

If your superannuation fund reports negative investment earnings for the year, your Division 296 tax assessment will be zero. In other words, no Division 296 tax will apply for that period.

If your fund has accumulated tax losses, these can generally be carried forward to reduce taxable gains in future years. This may help lower the fund’s earnings assessed for the Division 296 tax.

Only if you are able to reduce your total super balance to below $3 million by the assessment date (i.e. 30 June 2027), based on the transitional arrangement for the 2026/27 financial year. Otherwise, it may only reduce the tax marginally. This strategy should be weighed against other tax and retirement implications.

Options may include asset restructuring, timing withdrawals or contributions, and managing asset growth across different entities. Seek coordinated advice from tax and financial professionals.

Yes, based on the announced changes both thresholds will be indexed to inflation.

As many people have their superannuation spread across multiple accounts or super funds, Division 296 tax is assessed to the individual, not to their super fund directly. Individuals will have the option to either pay their Division 296 assessment personally, or elect for the payment to be made on their behalf from their superannuation fund.

Perpetual Private advice and services are provided by Perpetual Trustee Company Limited (PTCo) ABN 42 000 001 007, AFSL 236643. This information was prepared and used by PTCo. It contains general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable for your circumstances. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. The information is believed to be accurate at the time of compilation and is provided in good faith.

PTCo do not warrant the accuracy or completeness of any information contributed by a third party. This information, including any assumptions and conclusions is not intended to be a comprehensive statement of relevant practice or law that is often complex and can change. No company in the Perpetual Group (Perpetual Limited ABN 86 000 431 827 and its subsidiaries) guarantees the performance of any fund or the return of an investor’s capital. Past performance is not indicative of future performance.

The information on this website is intended for Australian residents or citizens who are currently located in Australia, or where expressly indicated, New Zealand residents or citizens who are currently located in New Zealand only, and should not be relied on by residents or citizens of any other jurisdiction. By clicking the “Proceed” button below, you are agreeing to the Terms & Conditions of use.

Please read this information carefully as it governs your use of this website. Except as otherwise indicated, the contents of this website and the products and services are intended for persons residing in the United States, and the information on this website is only for such persons. This website is not directed to any person in any jurisdiction where its publication or availability is prohibited. Persons in such jurisdictions must not use this website. By clicking the “Proceed” button below, you are agreeing to these terms.

Please read this information carefully as it governs your use of this website. The contents of this website and the products and services mentioned are intended for persons residing in Singapore, and the information on this website if only for such persons. This website is not directed to any person in any jurisdiction where its publication or availability is prohibited. By clicking the “Proceed” button below, you are agreeing to these terms.

This information and the terms of use are subject to change at any time without notice. The contents of this website are intended for residents and citizens of the United Kingdom, and the European Union, and should not be relied on by residents or citizens of other jurisdictions. All investment products and services referenced in this website are managed and offered by either JOHCM or its affiliates within the Perpetual Limited group of companies ("Perpetual Affiliates"). By clicking the “Proceed” button below, you are agreeing to the Terms & Conditions of use.

This information and the terms of use are subject to change at any time without notice. The contents of this website are intended for residents and citizens of the United Kingdom, and the European Union, and should not be relied on by residents or citizens of other jurisdictions. All investment products and services referenced in this website are managed and offered by either JOHCM or its affiliates within the Perpetual Limited group of companies ("Perpetual Affiliates"). By clicking the “Proceed” button below, you are agreeing to the Terms & Conditions of use.